Democratizing Markets

Through Innovation

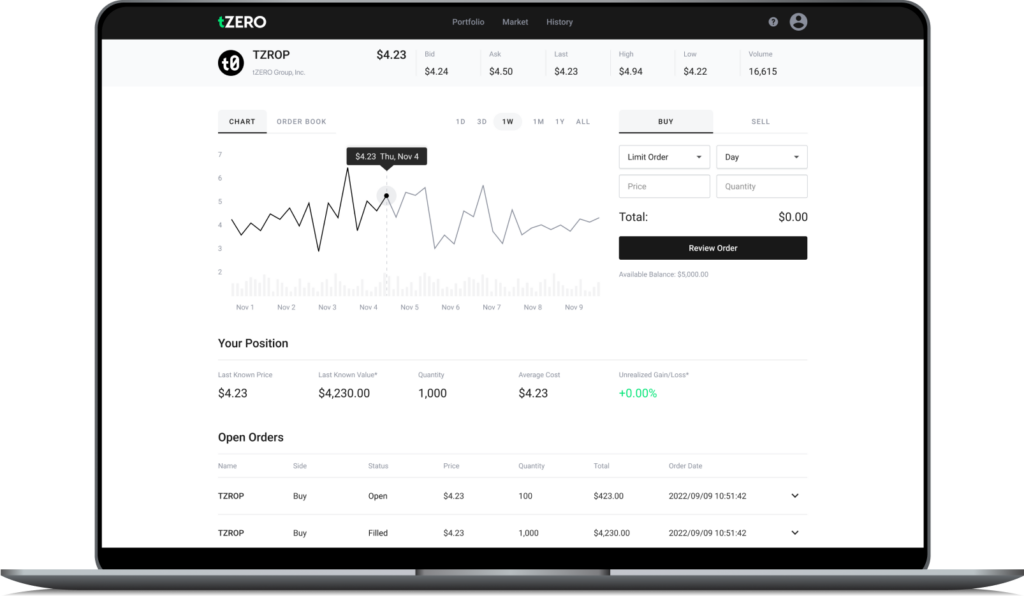

Over 44 Million Shares Traded on the tZERO Platform

tZERO is a financial technology company providing transformative market-based solutions for companies, entrepreneurs, and retail & institutional investors.

Raise Capital Using tZERO

Raise Capital for Your Company on Your Terms

tZERO can help your company raise capital through a variety of regulatorily compliant fundraising types; including Reg D, Reg A+ and Reg CF primary offerings.

INVEST WITH tZERO

Investment Opportunities

Access a wide range of investments including private companies, funds and digital assets.

INTRODUCTION

Pioneering the Next Generation of Capital Markets

Since its founding in 2014, tZERO’s mission has been to democratize access to capital markets by establishing more efficient, accessible, and transparent marketplaces. We work with companies to create innovative solutions and products for primary raises, recapitalizations, and secondary trading.

Primary & Secondary

Market Solutions

The tZERO advantage

What Sets Us Apart

Both private and public companies can appreciate the benefits of tZERO's regulated approaches to raising capital and secondary market trading, as well as innovative blockchain technology solutions to capital market challenges.

tZERO is one of the few regulated and licensed venues that supports both the traditional trading of private securities as well as digital securities utilizing the blockchain. This can include both regular security tokens and non-fungible tokens (NFTs) with benefits, such as fractionalized ownership, improved tracking, and accelerated settlement. tZERO meets its regulatory requirements for digital securities through its ownership of a FINRA-member broker-dealer and an SEC-registered alternative trading system (ATS).

As regulatory clarity for digital assets continues to evolve, we believe that many of the digital assets that exist today will be classified as securities. tZERO is a leading, digitally capable, regulated technology provider and marketplace. Since we operate in a highly regulated environment, we have pursued the appropriate regulatory licenses for these activities. We are committed to the issuance and trading of securities, including digital assets, in a fully compliant manner with the evolving regulations.

On February 22, 2022, tZERO announced that Intercontinental Exchange (NYSE: ICE), the parent company of the New York Stock Exchange, led tZERO's latest capital raise and became a significant investor. With ICE's backing, tZERO brings world-class technology, security, brand trust, and compliance capabilities. Additionally, we have established a comprehensive technology offering that has integrated with blockchains, transfer agents, broker-dealers, and other service providers.